201 2nd Ave

SW Buffalo Center IA 50424

Farmland Auction

For: Irene Wempen Estate and George Wempen Trust

Tuesday September 12th 10:00 a.m.

Heritage Town Center

201 2nd Ave, SW Buffalo Center IA 50424

Selling Winnebago and Kossuth County Farm Ground

Farm Data Sheets

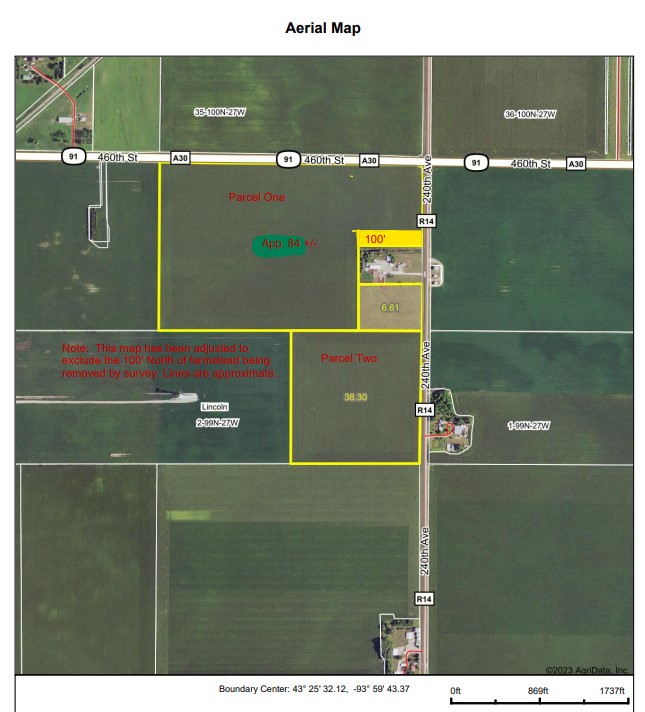

Parcel One: 87 Acres +/- in Kossuth County IA.

Location: Approximately Two Miles West and 2 ½ Miles North of Buffalo Center, Iowa laying along 240th Ave.

Short Legal Description: The NW NE of Section 2, Township 99, Range 27, and The NE NE of Section 2, Township 99, Range 27 except parcel 2 as described by survey doc #2023/1856

Parcel One and Parcel Two are currently farmed together. They currently together consist of 123.62 Cropland Acres according to the FSA. If they are purchased separately this parcel is expected to contain approximately 83.895 Tillable Acres. This number has been determined by using the current FSA cropland number less the tillable acres of Parcel Two (38.3 According to Surety Mapping) also less the net acreage of what has been surveyed off north of the building site (1.425). The two parcels together have a Corn Base of 123.60 acres with a PLC Yield of 146. This parcel receives a wind easement payment of $25 per acre, which adjusts 2.5% per year until 2055. This parcel also receives a payment from Alliant of $19,500 until 2058.

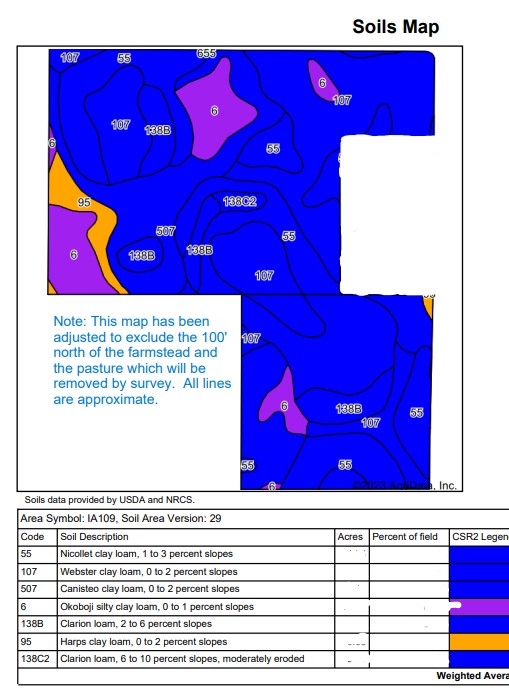

This Parcel will contain approximately 84.22 net taxable acres (after deducting new surveyed parcel). The current CSR2 according to the county is 83.1 (Note this includes 7.93 acres removed by new survey). The primary soil types are Nicollet, Canisteo, Webster, and Okoboji Clay Loams.

Parcel Numbers: 08-02-200-001; and 08-02-200-007 (less additional area removed by survey)

Current Year Property Tax Estimate: $3,358.10 (includes area removed by survey)

Parcel Two: 40 Acres +/- in Kossuth County IA.

Location: Approximately Two Miles West and 2 ½ Miles North of Buffalo Center, Iowa laying along 240th Ave.

Short Legal Description: The SE NE of Section 2, Township 99, Range 27 less that part of parcel 2 as described by survey doc #2023/1856 which extends into the SE NE.

This farm consists of 38.77 net acres according to Kossuth County. It is currently being farmed with Parcel One. The current CSR2 according to Kossuth County is 85.9. If this parcel is purchased separately it is expected to have approximately 38.3 tillable acres (Number Generated by Surety Mapping). This parcel receives a wind easement payment of $25 per acre, which adjusts 2.5% per year until 2055.

Note: If this parcel is not purchased by the same buyer as Parcel One, then the buyer shall be responsible for the creation of any necessary field drive.

Parcel Number: 08-02-200-004

Current Taxes: $1460.80

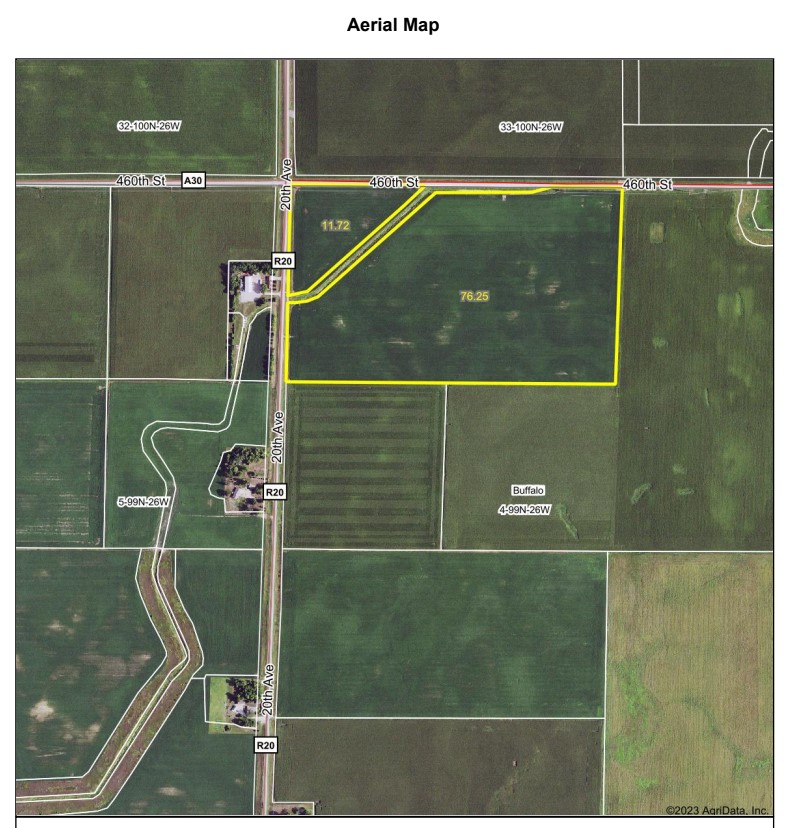

Parcel Three: 95.02 Acres +/- in Winnebago County IA

Location: From Buffalo Center the farm sits approximately one mile east and three miles north. It upon 20th Ave and 460th St.

Short Legal Description: NE FR NW Fr and NW NW of Section4, Township 99, Range 26.

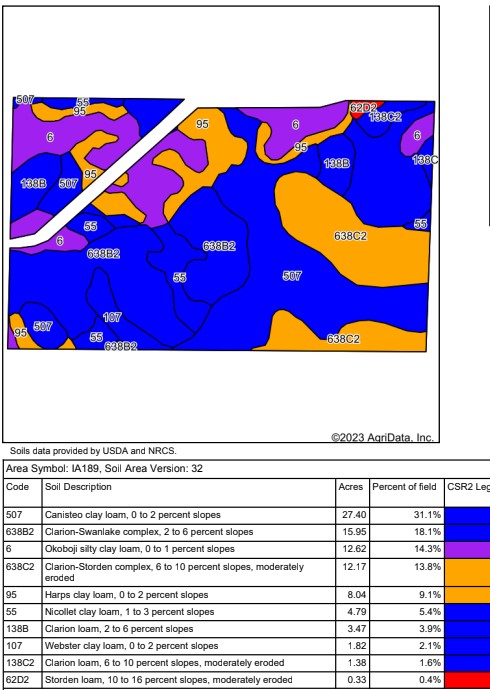

This farm is 86.06 net taxable acres according to Winnebago County. The FSA lists 91.74 Farm Land Acres and 87.97 Cropland Acres with a Corn Base of 87.81 acres and a PLC Yield of 143. It has a CSR2 of 78.6 according to Surety Mapping. It’s primary soil types are Canisteo, Clarion-Swan Lake, Okoboji, and Clarion Storden. This parcel receives a wind easement payment of $25 per acre, which adjusts 2.5% per year until 2055.

Method of Sale for Parcel One and Two: Purchase Price of each parcel will be the bid amount times the multiplier. Parcel One will have a multiplier of 84 and Parcel Two will have a multiplier of 39. These two parcels will be sold by the buyer’s choice method. The high bidder will have the option of taking either parcel or both for the bid amount times the multiplier. If the high bidder does not take both parcels, then the next will be offered. Method for Parcel Three: This parcel will be offered for the bid amount times the multiplier. The multiplier for parcel three will be 86.

Terms of Auction: Buyer will put 10 percent down non-refundable day of auction and rest due upon merchantable deed and abstract on or before 45 days. Taxes pro-rated to the date of closing. Seller’s Attorney is Patrick B. Byrne. All announcements made day of sale and contained in the purchase agreement will take precedence over printed material. All bids are subject to approval and acceptance of the trustees and executors. Buyers will receive possession upon closing subject to the rights of current tenants. Seller will retain all cash rent payments for 2023 crop year. Seller will also retain all wind easement and Alliant payments for 2023 crop year.